News Release

News Release

5 Best Do My Paper Services where you can hire paper writer

Spark Metro

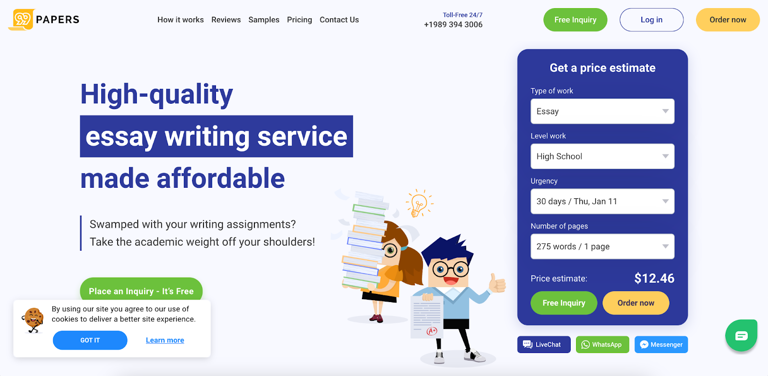

In today's fast-paced academic environment, students are increasingly seeking assistance from Do My Paper services to manage their overwhelming workload. These services, offered online, cater to a wide array of academic needs, ranging from essay writing to research papers, dissertations, and even personalized project assistance. Understanding what these services entail and the benefits they offer is crucial for students aiming to enhance their academic performance without compromising on quality or integrity. 99papers.com 🌟 (4.9/5) delivers exceptional writing services at budget-friendly prices. EssayBox.org 🌟 (4.9/5) stands out for its dependable, prompt delivery of high-quality work. BookWormLab.com 🌟 (4.8/5) specializes in creating intricate academic essays with expertise. EssayFactory.uk 🌟 (4.8/5) offers essays uniquely customized to meet UK academic standards. Essays.io 🌟 (4.7/5) features free academic papers catering to diverse needs. Explanation of Do My Paper Services Do My Paper services are essentially academic writing services that provide professional assistance to students across various levels of education. These platforms connect students with experienced writers who specialize in a broad spectrum of subjects and academic writing styles. The core promise of these services is to deliver custom-written papers that adhere strictly to the client's instructions, ensuring originality and academic integrity. This not only helps students save time but also allows them to gain insights into how to approach their assignments more effectively. Importance of Choosing the Right Service The significance of selecting the appropriate Do My Paper service cannot be overstated. A suitable service can dramatically influence a student's academic trajectory, offering them not just a well-written paper but also peace of mind and additional time to focus on other important aspects of their studies or personal life. Conversely, choosing a subpar service might result in receiving plagiarized content, facing delays in submission, or even encountering communication barriers that can lead to frustration and academic setbacks. TOP 5 Do My Paper Companies Reviewed 1. 99papers.com Website Link: 99papers.com Ratings: 4.9/5 Pricing: from $12.46 Discount code: cm0b15 (save 15%) 99papers.com is an academic writing service known for its comprehensive range of services catering to students at various academic levels. It has established itself as a reliable platform where students can find assistance with a wide array of assignments, from essays to dissertations. Overview of Services and Specialties Essays Research Papers Dissertations Term Papers Homework Help Proofreading and Editing Specialties include a focus on quick turnaround times and an ability to cover a diverse range of subjects, from English literature to complex scientific research papers. Benefits Quick Turnaround Times: 99papers.com is particularly noted for its ability to deliver quality work within tight deadlines, making it a go-to service for students facing urgent assignments. Diverse Subject Coverage: The platform boasts a large pool of writers with expertise in various fields, ensuring that almost any subject matter can be handled competently. Pros and Cons Pros: Affordable pricing structure that makes it accessible to a wide range of students. High-quality papers that adhere to academic standards and guidelines. Cons: Limited testimonials available on independent review platforms, which may make it challenging for new users to gauge service quality from unbiased sources. Testimonials Customers have praised 99papers.com for its reliability and quality of work. Many highlight the service's ability to handle complex topics and deliver assignments well within deadlines, often exceeding expectations in terms of content and adherence to specific requirements. FAQs What are the turnaround times for assignments? Turnaround times can be as quick as a few hours for urgent assignments, with more extended deadlines available for complex projects like dissertations. What is the revision policy? 99papers.com offers free revisions within a specific timeframe after the delivery of the final paper, provided the original instructions remain unchanged. How does pricing work? Pricing varies based on the type of assignment, academic level, number of pages, and deadline. A detailed quote is provided upon order submission. Is customer support available 24/7? Yes, 99papers.com provides round-the-clock customer support to address any inquiries or concerns. This review of 99papers.com presents it as a solid choice for students seeking affordable, high-quality academic writing assistance. Its broad range of services, quick turnaround times, and diverse subject coverage make it a versatile option for academic support. However, potential users may want to seek out more testimonials to ensure it meets their specific needs. 2. Essaybox.org Website Link: EssayBox.org Ratings: 4.9/5 Prices: $12.95 Promo Codes: cyt89rfd (10% Discount on the first order) Essaybox.org is an esteemed academic writing service recognized for delivering superior quality work across an extensive array of academic disciplines. It prides itself on providing highly customized writing assistance tailored to each student's specific requirements and academic goals. Range of Academic Services Offered Custom Essays Term Papers Research Papers Thesis and Dissertations Case Studies Lab Reports Book Reviews The service caters to students from high school up to Ph.D. levels, covering a wide spectrum of subjects including humanities, social sciences, natural sciences, and engineering. Benefits Free Revisions and Money-Back Guarantee: Essaybox.org stands behind the quality of its work by offering unlimited free revisions and a full money-back guarantee if the final product does not meet the client's expectations. Direct Communication with Writers: Clients have the benefit of direct communication with their assigned writers, facilitating a more personalized and collaborative approach to the writing process. Pros and Cons Pros: Superior quality of work that adheres to the highest academic standards. Extensive coverage of subject areas, with writers specialized in various disciplines. Cons: The pricing structure is on the higher side, making it less accessible to students on a tight budget compared to other services. Testimonials User reviews consistently highlight the exceptional quality of writing and customer service provided by Essaybox.org. Many customers appreciate the direct interaction with writers, which they feel contributes to more tailored and effective final papers. The professionalism and expertise of the writers often exceed expectations, with many clients returning for subsequent assignments. FAQs What qualifications do the writers have? Essaybox.org employs writers with at least a Master’s degree in their respective fields, with many holding Ph.D. degrees and having extensive writing and research experience. How does the order process work? The order process involves submitting detailed instructions through the website, after which a suitable writer is assigned to the project. Clients can communicate with their writer throughout the process for updates and clarifications. What is the policy on revisions? Free revisions are available for a certain period after the order is completed, as long as the original instructions are not changed. Can I get a refund if I'm not satisfied with the work? Yes, Essaybox.org offers a money-back guarantee if the final product does not meet the agreed-upon requirements or is not up to academic standards. Essaybox.org emerges as a premium choice for students seeking top-notch academic writing assistance. Its commitment to quality, coupled with the ability for direct writer communication, positions it as a highly reputable service. While the cost may be higher than some competitors, the value delivered through its rigorous standards and customer-centric policies justifies the investment for many students. 3. Bookwormlab.com Website Link: BookWormLab.com Ratings: 4.7/5 Prices: $14.59 Promo Codes: u9tgdm (10% Discount on the first order) Bookwormlab.com distinguishes itself in the academic writing service market through its strong emphasis on personalized writing services. This platform is dedicated to providing custom-tailored assistance that meticulously aligns with each client's unique requirements, academic goals, and personal voice. Focus on Personalized Writing Services Bookwormlab.com offers a broad spectrum of writing services, each adapted to the specific instructions and expectations of the client. This includes: Custom Essays Research Papers Term Papers Case Studies Coursework Assistance Admissions Essays Editing and Proofreading Services Their approach is rooted in understanding the individual needs of students and offering solutions that are not just about meeting academic standards but also reflecting the client’s personal style and voice. Benefits Plagiarism-Free Content, Custom Writing: A guarantee of 100% original content that is custom-written for each client, ensuring both uniqueness and compliance with academic integrity standards. Exceptional Customer Service: A dedicated customer support team that provides timely and helpful assistance, enhancing the overall service experience. Pros and Cons Pros: A highly personalized approach to every order, ensuring that the final product closely matches the client’s expectations and requirements. Exceptional customer service that is responsive, helpful, and available to address any concerns or questions. Cons: The pricing structure may be slightly above the average market rate, reflecting the premium nature of the personalized services offered. Testimonials Customers frequently express high levels of satisfaction with the quality of work and the personalized attention they receive from Bookwormlab.com. Many testimonials praise the service for its ability to understand and implement specific, individualized requests, resulting in academic papers that accurately reflect the client's voice and meet their objectives. Repeat business and referrals are commonly cited, indicating a strong trust in the service’s ability to deliver consistently high-quality work. FAQs How does the customization process work? Upon placing an order, clients are asked to provide detailed instructions and any personal preferences they have for the assignment. This information is then used by the assigned writer to tailor the work specifically to the client’s needs. What are the typical deadlines, and can they accommodate urgent orders? Bookwormlab.com can handle a wide range of deadlines, from several weeks to as short as a few hours for urgent needs. However, it is recommended to place orders in advance to ensure the best possible outcome. Is there a guarantee for plagiarism-free content? Yes, Bookwormlab.com guarantees that all content is original and plagiarism-free, providing a plagiarism report upon request. What if I’m not satisfied with the final product? The service offers revisions to address any areas of concern and ensure that the final output meets or exceeds expectations. A customer’s satisfaction is a top priority. Bookwormlab.com offers a premium, customized writing service that stands out for its attention to detail and personalized approach. While the cost may be slightly higher, the value of receiving work that is tailor-made to fit specific requirements and academic goals is a significant advantage for students who prioritize quality and individuality in their academic work. 4. Essayfactory.uk Website Link: EssayFactory.uk Ratings: 4.7/5 Prices: $14.59 Promo Codes: u9tgdm (10% Discount on the first order) Essayfactory.uk sets itself apart in the academic writing service sector by specializing in assignments that require a deep understanding of UK academic standards and conventions. This focus ensures that students studying in the UK or those needing assignments tailored to UK guidelines receive expert assistance that accurately reflects these requirements. Specialization in UK-based Assignments The core services of Essayfactory.uk include a range of academic writing assistance tailored specifically to the UK educational system, such as: Custom Essays Dissertations Term Papers Thesis Writing Coursework Help Editing and Proofreading This specialization extends to ensuring that all work adheres to the specific citation styles, grading criteria, and academic nuances unique to the UK. Benefits Adherence to UK Academic Standards: A commitment to upholding the strict academic standards and formats prevalent in UK institutions. Timely Deliveries: Recognizing the importance of deadlines, Essayfactory.uk emphasizes prompt delivery without compromising on quality. Pros and Cons Pros: Expertise in UK-specific academic writing requirements, providing a valuable service for students within the UK education system. Reliable customer support that is attuned to the needs and expectations of UK students. Cons: Services are primarily designed for the UK format, which might limit options for students requiring assistance with assignments tailored to other academic styles or standards. Testimonials Both UK and international students have lauded Essayfactory.uk for its exceptional understanding of UK academic standards and its ability to deliver high-quality work within tight deadlines. Feedback often highlights the service's professionalism and the high marks received for papers written with their assistance. FAQs What are the main differences between UK and US academic writing standards? UK academic writing often requires a more formal tone, specific citation styles (such as Harvard referencing), and adherence to particular grading criteria. Essayfactory.uk is well-versed in these distinctions and tailors its services accordingly. Can Essayfactory.uk handle urgent orders? Yes, the service is equipped to manage urgent orders, with the capability to deliver assignments as quickly as within a few hours, depending on the complexity and length of the paper. Is support available for non-UK students studying in UK institutions? Absolutely, Essayfactory.uk provides support for international students in the UK, helping them navigate the specific requirements and academic practices unique to the UK. What if I need revisions? The service offers revisions to ensure that the final product meets all specified requirements and academic standards, ensuring customer satisfaction. Essayfactory.uk stands as a premier choice for students seeking assistance with UK-based academic assignments. Its specialized focus on UK standards, combined with reliable support and timely delivery, makes it an invaluable resource for students aiming to excel within the UK educational framework. However, those needing help with non-UK formats may need to consider other services better aligned with their specific requirements. 5. Essays.io Website Link: Essays.io Ratings: 4.5/5 Prices: $11.31 Promo Codes: custom10 (10% Discount on the first order) Essays.io is a comprehensive academic writing service that caters to a wide range of academic needs across various levels. Its broad spectrum of services is designed to support students from high school to postgraduate levels, offering tailored writing assistance for essays, research papers, dissertations, and more. Broad Range of Writing Services and Academic Levels The platform's strength lies in its versatility, providing assistance with: Essays Research Papers Dissertations Thesis Proposals Lab Reports Book Reviews Admissions Essays Editing and Proofreading Services This extensive service offering ensures that students can find support for virtually any academic challenge they face, regardless of the subject area or complexity. Benefits Versatile Services for Various Academic Needs: Essays.io is equipped to handle a diverse array of assignments, making it a one-stop-shop for students seeking academic assistance. Competitive Prices: The platform offers competitive pricing models, making professional writing services accessible to a broader range of students. Pros and Cons Pros: A comprehensive suite of services that caters to a wide range of academic disciplines and levels, from high school to doctoral studies. Competitive pricing that provides value for money, making it an attractive option for students on a budget. Cons: Variable writer quality, as reported by some users, suggesting that experiences can differ significantly depending on the assigned writer. Testimonials Customer feedback on Essays.io is generally positive, with many users praising the service for its broad range of offerings and the quality of its work. However, some reviews highlight inconsistencies in writer quality, suggesting that while many have had excellent experiences, a few have encountered issues with the level of expertise or writing style of their assigned writers. FAQs What types of services does Essays.io offer? Essays.io offers a comprehensive array of academic writing services, including but not limited to essays, research papers, dissertations, thesis proposals, and editing services. How does the writer match process work? The service matches clients with writers based on the assignment's requirements and the writer's area of expertise, aiming to ensure the best possible fit between the client's needs and the writer's skills. Can I communicate with my writer directly? Yes, Essays.io allows direct communication with writers, enabling clients to clarify requirements, provide additional information, and discuss specific aspects of the assignment. What if I'm not satisfied with the completed work? Essays.io offers revisions to address any concerns with the completed work, ensuring that the final product meets the client's expectations and requirements. Essays.io stands out for its broad service offerings and competitive pricing, making it an appealing choice for students across various academic levels and disciplines. While the variable writer quality is a noted concern, the platform's commitment to customer satisfaction through revisions and direct communication channels helps mitigate these issues. For students seeking versatile and affordable academic writing assistance, Essays.io presents a compelling option. How to Choose the Best Do My Paper Service Choosing the best Do My Paper service requires careful consideration of several factors to ensure that you receive quality work that meets your academic needs without straining your budget. Here's a guide on how to compare these services effectively and the role of reviews and testimonials in making an informed decision. Comparison of Factors Quality of Work: The most critical factor is the quality of the academic work provided. High-quality papers are well-researched, properly formatted, free from grammatical errors, and adhere strictly to the assignment's requirements. Look for services that guarantee plagiarism-free content and have a team of qualified writers with expertise in your field of study. Price: While affordability is important, especially for students on a tight budget, the cheapest option is not always the best. Compare prices across services but consider the value you're getting. Some platforms offer lower prices but may compromise on quality or have hidden fees. Transparent pricing and the availability of discounts or loyalty programs can indicate a service's commitment to affordability without sacrificing quality. Delivery Time: Timeliness is crucial, as late submissions can negatively impact your grades. Evaluate the service's track record for meeting deadlines, including feedback on their ability to handle urgent orders. Services that offer a range of deadlines and can accommodate urgent requests without compromising quality should be prioritized. Customer Support: Effective communication and support are essential for a smooth and satisfactory service experience. The best Do My Paper services offer 24/7 customer support, allowing you to track your order's progress, communicate with your writer, and address any concerns promptly. Look for services that provide multiple channels for support, such as live chat, email, and phone. Importance of Reviews and Testimonials in Decision-Making Real User Experiences: Reviews and testimonials offer insight into the experiences of previous customers with the service. They can provide valuable information about the quality of work, writer expertise, customer service, and how well the company meets deadlines. Service Reputation: Consistently positive reviews can indicate a reliable service that meets its promises. Conversely, recurring complaints about certain aspects, such as quality or timeliness, should raise red flags. Objective Evaluation: Look for detailed reviews that discuss specific aspects of the service, as these can give you a more nuanced understanding of what to expect. Independent review platforms or forums can offer more unbiased opinions compared to testimonials featured on the company's website. Resolution of Complaints: Pay attention to how the service responds to negative feedback. A company that actively addresses and resolves complaints demonstrates a commitment to customer satisfaction and is likely to offer a more reliable and responsive service. In conclusion, choosing the best Do My Paper service involves a balanced assessment of quality, price, delivery time, and customer support. Reviews and testimonials play a crucial role in this process, offering real-world insights that can help you make an informed choice. By carefully evaluating these factors and considering the experiences of past users, you can select a service that best meets your academic needs and ensures a positive outcome. Overview of the Criteria for Selecting the Top 5 Companies In compiling a list of the top 5 Do My Paper companies, several critical factors were taken into account to ensure that the recommendations meet a high standard of reliability, quality, and customer satisfaction. These criteria include: Quality of Writing: The primary criterion is the quality of the work produced. This encompasses the writers' ability to follow instructions, use of credible sources, and adherence to the specified academic style and formatting. Turnaround Time and Reliability: Companies must demonstrate their ability to meet deadlines, including for urgent orders, without compromising the quality of the work. Pricing and Affordability: While students seek affordable options, it's important that cheap pricing does not come at the expense of quality. The selected companies offer a good balance of cost-effectiveness and high-quality work. Customer Reviews and Testimonials: Genuine customer feedback provides insights into the reliability and effectiveness of a service. Companies with positive testimonials from a diverse set of clients are preferred. Customer Support and Service: Efficient, responsive, and helpful customer support is crucial. The companies chosen excel in providing excellent customer service, ensuring a smooth and positive experience for students. Plagiarism-Free Guarantee: Ensuring that all work is original and free from plagiarism is non-negotiable. The top companies provide plagiarism reports to verify the uniqueness of their work. By focusing on these criteria, the article aims to guide students towards making informed decisions when selecting a Do My Paper service, ultimately helping them achieve their academic goals while maintaining integrity and high standards. The Concept Behind Do My Paper Online The concept of "Do My Paper Online" services has revolutionized the way students approach their academic assignments. These services offer a practical solution to the challenges many students face, including time constraints, lack of confidence in their writing skills, and the need to balance academic responsibilities with personal obligations. Understanding the definition of these services and the variety they offer, alongside recognizing the factors driving their growing demand, is essential for anyone considering utilizing them. Definition and Services Offered "Do My Paper Online" refers to the digital provision of academic writing services through various platforms where students can request custom-written papers on a wide range of topics and subjects. These services are designed to cater to the specific needs of each student, taking into account the requirements of their assignments, the academic level, and any particular preferences or instructions they might have. The spectrum of services includes, but is not limited to: Essay Writing: From argumentative essays to reflective pieces, these services cover all types of essays. Research Papers: Comprehensive assistance with research papers, including help with formulation of thesis statements, research, and writing. Dissertations and Theses: In-depth support for more complex projects like dissertations and theses, encompassing proposal writing, literature review, methodology, and more. Term Papers: Assistance with term papers that count significantly towards final grades. Case Studies: Help with analyzing and writing up case studies across various disciplines. Coursework: Support for routine coursework assignments to help students manage their workload. The Growing Demand for Academic Assistance Several factors contribute to the increasing reliance on "Do My Paper Online" services among students globally: Increased Academic Pressure: The rising standards and expectations in educational institutions put significant pressure on students to perform exceptionally in all aspects of their academic life, driving the need for external support. Time Management Challenges: With many students juggling academic responsibilities alongside part-time jobs, internships, or personal commitments, finding the time to complete all assignments on time can be challenging. Access to Expertise: These services provide access to professionals with specialized knowledge and experience in various fields, offering students the opportunity to improve the quality of their work and gain new perspectives on their subjects. Improvement in Grades: The assistance provided by Do My Paper services can directly impact students' grades, helping them achieve or maintain a high academic standing. Language Barriers: International students, in particular, may seek these services to overcome challenges with writing in English, ensuring their ideas are communicated clearly and effectively. Learning and Development: Beyond just submitting assignments, engaging with these services can offer students valuable learning experiences. They can gain insights into how to structure arguments, conduct research, and write academically, skills that are beneficial in both their academic and future professional lives. The demand for "Do My Paper Online" services is a reflection of the evolving educational landscape, where such platforms are increasingly viewed as vital resources for students seeking to navigate the challenges of academic life successfully. Choosing a Do My Paper Cheap Service Choosing a "Do My Paper Cheap" service is a critical decision for students who are looking to save on costs without sacrificing the quality of their academic work. While affordability is a key concern, it is crucial to ensure that the low cost does not lead to poor quality work, plagiarism, or other issues that could negatively impact one's academic career. Here, we'll explore the factors to consider when selecting a budget-friendly service and how to strike the right balance between cost and expertise. Factors to Consider for Affordability Without Compromising Quality Writer Qualifications: Investigate the qualifications and experience of the writers employed by the service. A reputable service should have a team of writers with at least a bachelor's degree in their respective fields, if not higher. Their academic background and writing experience are critical in ensuring the quality of the work produced. Plagiarism Policies: Ensure that the service has a strict anti-plagiarism policy and uses reliable plagiarism detection software to verify the originality of their papers. A cheap service should still provide guarantees that the work is original and provide a plagiarism report upon request. Customer Reviews and Testimonials: Look for genuine reviews and testimonials from previous clients. Positive feedback from other students can be a good indicator of the quality of work you can expect, even from a low-cost service. Sample Works: Request or seek out sample works to assess the quality of writing, depth of research, and adherence to academic standards. Samples can give you a clear idea of what to expect and help you decide if the service meets your needs. Revisions Policy: A reliable service should offer free revisions if the delivered work does not meet the initial requirements or expectations. Understanding the revisions policy is essential to ensure you won't incur additional costs for adjustments. Customer Support: Effective and responsive customer support is crucial, especially when working with a budget service. You want to ensure that you can quickly resolve any issues or questions that may arise. The Balance Between Cost and Expertise Striking the perfect balance between cost and expertise involves understanding that the cheapest option is not always the best. Here are some strategies to achieve this balance: Prioritize Value Over Price: Look for services that offer the best value for money rather than the lowest absolute price. This means considering the quality of work, the qualifications of the writers, and the additional services provided. Use Discounts and Offers: Many reputable services offer discounts, especially for first-time customers or for bulk orders. Take advantage of these offers to reduce costs without compromising on quality. Customize Your Order: Some platforms allow you to customize your order based on what you're willing to pay. Opting for a longer deadline, for example, can significantly reduce the price compared to urgent orders. Do Your Homework: Extensive research and comparison of different services are crucial. Don't settle for the first cheap service you find. Instead, compare several options based on the factors mentioned above to find the best deal. In conclusion, choosing a "Do My Paper Cheap" service requires careful consideration of various factors to ensure that affordability does not come at the expense of quality. By focusing on the qualifications of the writers, plagiarism policies, customer feedback, and the overall value offered, students can find a service that meets their academic needs without breaking the bank. Benefits of Using Do My Paper Services Using Do My Paper services offers several benefits that can significantly impact a student's academic life and overall well-being. These services are designed not only to help students manage their workload more effectively but also to enhance their academic performance through professional assistance. Here are some of the key benefits: Time Management and Academic Balance Alleviates Workload: Students often juggle multiple assignments, exams, and personal responsibilities. Do My Paper services can alleviate this workload by taking care of time-consuming writing assignments, allowing students to focus on other important tasks or studies. Reduces Stress: Managing a heavy academic workload can be stressful. Outsourcing some of your writing tasks can reduce stress levels and prevent burnout, contributing to a healthier academic life. Enables Prioritization: With some assignments handled by professionals, students can prioritize their academic tasks more effectively, focusing on subjects or projects that require their direct attention or are of greater personal or academic significance. Improvement in Academic Performance Enhances Quality of Work: Professional writers bring a level of expertise and experience to academic papers that many students are still developing. This can significantly improve the quality of the submitted work, leading to better grades. Learning Tool: High-quality papers provided by these services can serve as excellent learning tools, offering insights into how to structure arguments, use sources effectively, and adhere to academic formatting standards. Feedback for Improvement: Some services offer feedback and suggestions for improvement, providing a valuable opportunity for students to learn from professionals and enhance their own writing skills. Access to Professional Writing Assistance Expertise in Diverse Subjects: Do My Paper services employ writers with expertise across a wide range of subjects and academic levels, ensuring that students can find assistance regardless of their field of study. Customized Support: These services offer customized support tailored to the specific requirements of each assignment, ensuring that the final product closely adheres to the assignment guidelines and personal preferences. Improves Research and Writing Skills: By reviewing and analyzing professionally written papers, students can improve their research and writing skills, gaining insights into effective writing practices that they can apply to their future assignments. Conclusion The benefits of using Do My Paper services extend beyond simply having someone write a paper on your behalf. These services offer a strategic advantage in managing academic workload, improving academic performance through access to professional expertise, and providing a valuable learning tool for enhancing one's writing and research skills. By utilizing these services judiciously, students can achieve a better balance in their academic life, reduce stress, and pave the way for academic success. Common Concerns with Do My Paper Services Using Do My Paper services comes with its share of concerns, primarily centered around ethical considerations and the assurance of plagiarism-free work. Understanding these concerns and knowing how to navigate them responsibly is crucial for students who choose to use these services. Here's a deeper look into these common concerns: Ethical Considerations Academic Integrity: The most significant ethical concern is maintaining academic integrity. It's essential to use these services responsibly, ensuring they don't cross the line into academic dishonesty. Many educational institutions have strict policies against plagiarism and submitting work that is not your own. Responsible Use: To use these services ethically, students should treat the papers they receive as study aids or models for their own work, rather than submitting them verbatim. This approach can help students learn from the structure, content, and style of professional writers while still producing a piece of work that is genuinely their own. Transparency with Service Providers: Opting for services that promote academic integrity and offer guidance on how to use their work responsibly is vital. Some services explicitly state that their papers are meant to serve as model papers, guides, or references. Ensuring Plagiarism-Free Work Originality Guarantees: Most reputable Do My Paper services guarantee that their work is original and free from plagiarism. This is often backed by a plagiarism report that confirms the uniqueness of the paper. Understanding Plagiarism Policies: It's important for students to understand what constitutes plagiarism and how to avoid it. Using a paper written by someone else as if it were your own work falls under this category, so modifications and critical engagements with the material are essential. Utilizing Plagiarism Checkers: Before submitting any paper received from such a service, students should use plagiarism checkers to verify the work's originality. This step ensures that any inadvertent similarities can be addressed before submission. How to Use These Services Responsibly As Learning Tools: Use the papers as examples or models to guide your writing. Analyze the structure, argumentation, and use of sources to improve your writing skills. Incorporate Personal Insights: Use the model paper as a foundation but make sure to incorporate your analysis, insights, and perspectives to create a piece that reflects your understanding and voice. For Drafting and Research Assistance: Use these services for assistance with drafting or research, especially for complex topics or when you're struggling with starting your paper. This can help you overcome writer's block and gather a wide range of sources. Cite Appropriately: If you use ideas or specific segments from the service's work, make sure to cite them appropriately to avoid plagiarism. Conclusion While Do My Paper services can be a valuable resource for students under certain conditions, it's imperative to approach them with a clear understanding of the ethical implications and a commitment to academic integrity. By using these services responsibly—as tools for learning and improvement rather than shortcuts to academic achievements—students can navigate the potential pitfalls and make the most of the assistance these services offer. Ensuring the originality of the work and engaging critically with the content are key steps in using these services ethically and effectively. FAQs about Do My Paper Services What are Do My Paper services? Do My Paper services are online platforms that provide academic writing assistance to students. These services offer to write essays, research papers, dissertations, and other types of academic assignments on behalf of students. The services are intended to serve as additional support for students' educational pursuits, offering customized writing based on the client's requirements. How can I be sure that using a Do My Paper service is confidential? Reputable Do My Paper services prioritize client confidentiality and data protection. They implement secure payment systems and encrypt client information to protect privacy. Additionally, these services often assure that they do not share personal information with third parties or publish the client's work without consent. Always read a service's privacy policy to understand how your data is protected. Is it ethical to use Do My Paper services? The ethical considerations hinge on how you use the service. It is considered ethical if you use the papers as study aids, for research assistance, or as examples to guide your writing. However, submitting these papers as your own work without proper citation can breach academic integrity policies. It's crucial to follow your educational institution's guidelines and use these services responsibly. How do I ensure the work I receive is plagiarism-free? Reputable services guarantee the originality of their work by providing plagiarism reports from recognized plagiarism checking software. To ensure the work you receive is plagiarism-free, you can request a plagiarism report and also use third-party plagiarism checkers to verify the uniqueness of the paper before submission. How does the ordering process work? The ordering process typically involves the following steps: Specification: You provide detailed instructions about your paper, including the topic, length, deadline, formatting style, and any specific requirements or guidelines. Payment: You complete the payment for the service, often through secure online payment platforms. Writing Process: A writer specialized in your subject area is assigned to your paper and begins working on it according to your specifications. Review and Delivery: Upon completion, you receive the paper and have the opportunity to review it. Many services offer revisions if the paper does not meet your initial requirements. Final Submission: Once you're satisfied with the work, you can use the paper as a model or guide for your own writing. Can I communicate with the writer directly? Many Do My Paper services allow direct communication with the writer assigned to your project. This feature enables you to provide additional information, clarify requirements, and check on the progress of your paper, ensuring that the final product aligns closely with your expectations. What if I'm not satisfied with the paper I receive? Most reputable services offer free revisions within a certain period after the paper's delivery. If the final product does not meet your specified requirements or expectations, you can request revisions or adjustments. Ensure you understand the service's revision policy before placing an order. How do I choose a reliable Do My Paper service? Choosing a reliable service involves researching and considering factors such as the service's reputation, reviews from previous clients, the qualifications of their writers, guarantees offered (such as plagiarism-free work and confidentiality), and their commitment to meeting deadlines. It's also beneficial to compare pricing and services offered to find the best fit for your needs. Conclusion In conclusion, selecting the right Do My Paper service is a crucial decision that can significantly impact your academic journey. The right service not only provides you with high-quality, plagiarism-free academic assistance but also ensures confidentiality, timely delivery, and adherence to your specific requirements. This decision should be informed by careful consideration of various factors, including the service's reputation, the quality of work it produces, its pricing, and the experiences of previous users. Using Do My Paper services responsibly can offer numerous benefits, including enhanced time management, improved academic performance, and access to professional writing assistance. However, it's essential to approach these services with an understanding of the ethical considerations involved. By using the papers as models or guides for your own work and ensuring that you engage with the material critically, you can use these services to complement your educational efforts without compromising your integrity. Remember, the goal of these services is to support your learning process, not to replace it. The best Do My Paper services are those that work with you to enhance your understanding of your subject matter and improve your writing and research skills. By choosing wisely and using these services ethically, you can make the most of the support they offer while maintaining your commitment to academic excellence. Contact Details Smart Content, LLC Robert Novak +1 302-597-6768 robert@smartcontentllc.com Company Website https://www.smartcontentllc.com

March 14, 2024 02:32 AM Eastern Daylight Time

Image

News Release

News Release